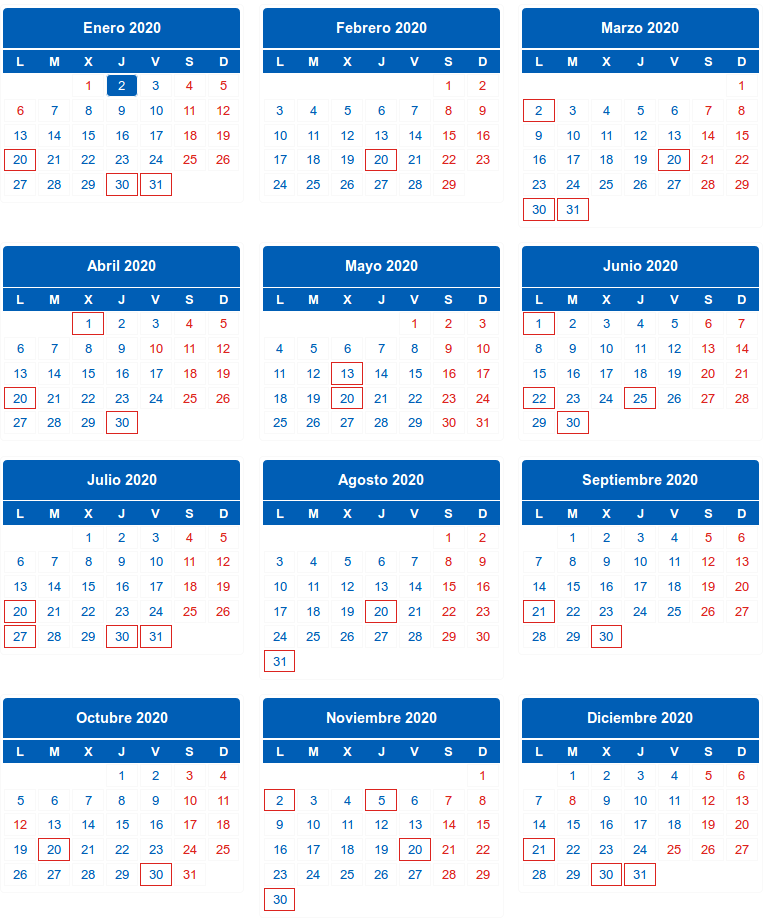

The Tax Agency has already published the taxpayer's tax calendar for the year 2020. This tax calendar 2020 includes the deadlines and filing methods for tax forms, as well as the most notable updates that will affect the upcoming year. Self-employed individuals and companies must file VAT, Corporate Income Tax, or Personal Income Tax forms, among other tax obligations, so it is crucial to keep this in mind to avoid any violations.

The calendar can be consulted with all the information on the AEAT's website , which provides detailed models, obligations, and deadlines: https://www.agenciatributaria.es/AEAT.internet/Inicio/Ayuda/Manuales__Folletos_y_Videos/Folletos_informativos/Calendario_del_contribuyente/Calendario_del_contribuyente_2020_HTML/_Calendario_/_Calendario_.shtml

There is also a PDF version downloadable.

Updates to the 2020 tax calendar

The regulations, in general, remain unchanged, but there are some important updates to be aware of.

NEWS

- The 190, 347 and 390 forms corresponding to the 2019 ax year will be filed using the help form or file. They cannot be submitted via SMS.

- The form and XSD file for model 231"Country-by-Country Information" have been modified. Declarations for years prior to 2019 that are filed in 2020 will continue to use the current form and XSD file until November 10, 2020 (after this date, the new version will be used). The declaration for the 2019 tax year, filed in 2020, will use the new form and XSD file.

- Model 234 "Declaration of information on certain cross-border tax planning mechanisms" has been approved: within 30 days following the obligation to report (starting from July 1, 2020). For the transitional period (June 25, 2018, to June 30, 2020): July and August 2020.

- Model 235 "Declaration of information on the update of certain marketable cross-border tax planning mechanisms" has been approved: the next calendar month following the end of the natural quarter in which new information that must be reported is obtained (starting from July 1, 2020). Model 235 will be first filed (excluding the transitional period) in October 2020.

- Model 318 "Adjustment of taxation ratios for settlement periods prior to the start of regular supply of goods or provision of services": January 1 to 30.

IMPORTANT: The annual declaration for Model 349 for the 2019 tax year will be filed in January 2020. STARTING FROM 2020, THERE WILL NO LONGER BE AN ANNUAL DECLARATION.

- Establishments that keep records of goods subject to Excise Duty (forms 553, 554, 555, 556, 557, 558, 570, and 580) through the Tax Agency's Electronic Headquarters will be exempt from the obligation to file transaction reports related to Excise Duties.

- Establishments authorized as factories, bonded warehouses, fiscal warehouses, receiving warehouses, and vinegar factories will be required to keep records of Excise Duties through the Tax Agency's Electronic Headquarters starting from January 1, 2020.

These establishments may submit the accounting entries for the first half of 2020 between July 1 and September 30, 2020. Those opting for this system must fulfill the accounting obligations set out in Article 50 of the Excise Duty Regulation in effect until December 31, 2019, until June 30, 2020, and also file the transaction reports (forms 553, 554, 555, 556, 557, 558, 570, and 580) for the first half of 2020.